Tetrapolar: Building Bitcoin-Native Settlement for Global Trade

The journey to build a bitcoin-native, non-custodial platform designed to coordinate high-value global transactions with final settlement enforced by Bitcoin itself.

Why I Started Tetrapolar

For most of its existence, bitcoin has been viewed primarily as a store of value. That framing made sense in its early years, when volatility was extreme and adoption limited to a relatively small group of early users. But markets evolve. As adoption increases, liquidity deepens, and volatility gradually compresses, bitcoin’s role expands.

Bitcoin is not just a scarce asset. It is a global settlement network with properties no legacy system can replicate: finality without intermediaries, resistance to censorship, and the ability to move large amounts of value across borders without permission. For small payments, convenience layers and local rails may dominate. For large-value transfers, especially across jurisdictions, settlement quality matters more than speed or UX polish.

Hard assets require hard settlement. As global trade increasingly spans multiple legal systems, currencies, and counterparties, the demand for a neutral, final settlement layer grows. Bitcoin is uniquely positioned to fill that role. Tetrapolar was created to serve that future.

Who Tetrapolar Is For

Tetrapolar is designed for participants in high-value, real-world transactions where trust, coordination, and settlement finality are critical.

This includes:

- Importers and exporters settling international trade without relying on correspondent banking.

- Dealers and brokers handling yachts, aircraft, luxury vehicles, real estate, fine art, or collectibles.

- Private individuals buying or selling high-value assets across borders.

- Service providers coordinating milestone-based work, retainers, or large one-off contracts.

What these users have in common is not volume, but value per transaction. When a single deal represents hundreds of thousands or millions of dollars, minimizing counterparty risk matters more than shaving a few basis points in fees.

From Boutique Concierge to Platform

Tetrapolar did not begin as a fully formed software platform. It began as a conceptual concierge model: a thought experiment around how high-value Bitcoin transactions should be coordinated if one were to design the system from first principles.

While exploring potential use cases—global trade, high-value asset transfers, cross-border services—it became clear that the core problem was not escrow in the traditional sense. The real gap was the absence of a neutral coordination layer where counterparties could structure a deal, agree on conditions, and settle in Bitcoin without introducing custodial risk or unilateral control.

Existing solutions either rely on trusted intermediaries, require one party to take custody, or force participants into legal and banking frameworks that negate Bitcoin’s core advantages. What was needed instead was a system where Bitcoin itself enforces the outcome, and the platform merely coordinates intent.

That realization shaped Tetrapolar’s direction. Rather than operating as an agent that holds or controls funds, Tetrapolar was designed as a non-custodial platform that enables buyers and sellers to coordinate Bitcoin-native deals while retaining full control of their keys and capital.

How the Tetrapolar Platform Works

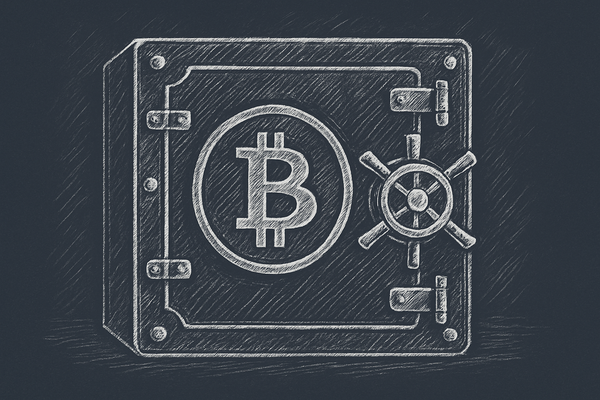

At its core, Tetrapolar uses bitcoin multisignature wallets to align incentives and enforce deal logic cryptographically rather than contractually.

Each deal is governed by a wallet with multiple spending paths:

- Primary settlement path (2-of-2):

The buyer and seller alone control the funds. If both agree, funds are released or refunded without any third-party involvement. - Dispute and recovery path (2-of-3):

A third key held by Tetrapolar exists solely for dispute resolution or key-loss recovery. Tetrapolar cannot move funds unilaterally and cannot act unless one of the two principals participates.

Importantly, all Bitcoin keys are generated and stored locally in the user’s browser. Tetrapolar never sees, stores, or controls private keys. There is no custodial risk, no pooled funds, and no ability for the platform to freeze or redirect assets.

The platform itself handles coordination: deal creation, participant roles, transaction state, and communication. Bitcoin enforces the settlement.

Beyond the Basics

The initial public release of Tetrapolar focuses on covering the majority of real-world use cases cleanly and securely. That foundation includes simple deal setup, robust multisig coordination, and clear settlement flows.

But Tetrapolar is not intended to remain static.

Over time, the platform will expand toward becoming a go-to settlement layer for global trade, with features such as:

- Bitcoin-native USDT support, enabling stable unit-of-account settlement without leaving the Bitcoin ecosystem.

- Flexible deal structures, including milestones and staged releases.

- Reusable deal templates for common transaction types.

- Trade-finance primitives, enabling capital-efficient settlement flows without forced asset sales.

These are not promises or timelines—only direction. Tetrapolar is built with extensibility in mind, but development will remain deliberate and conservative.

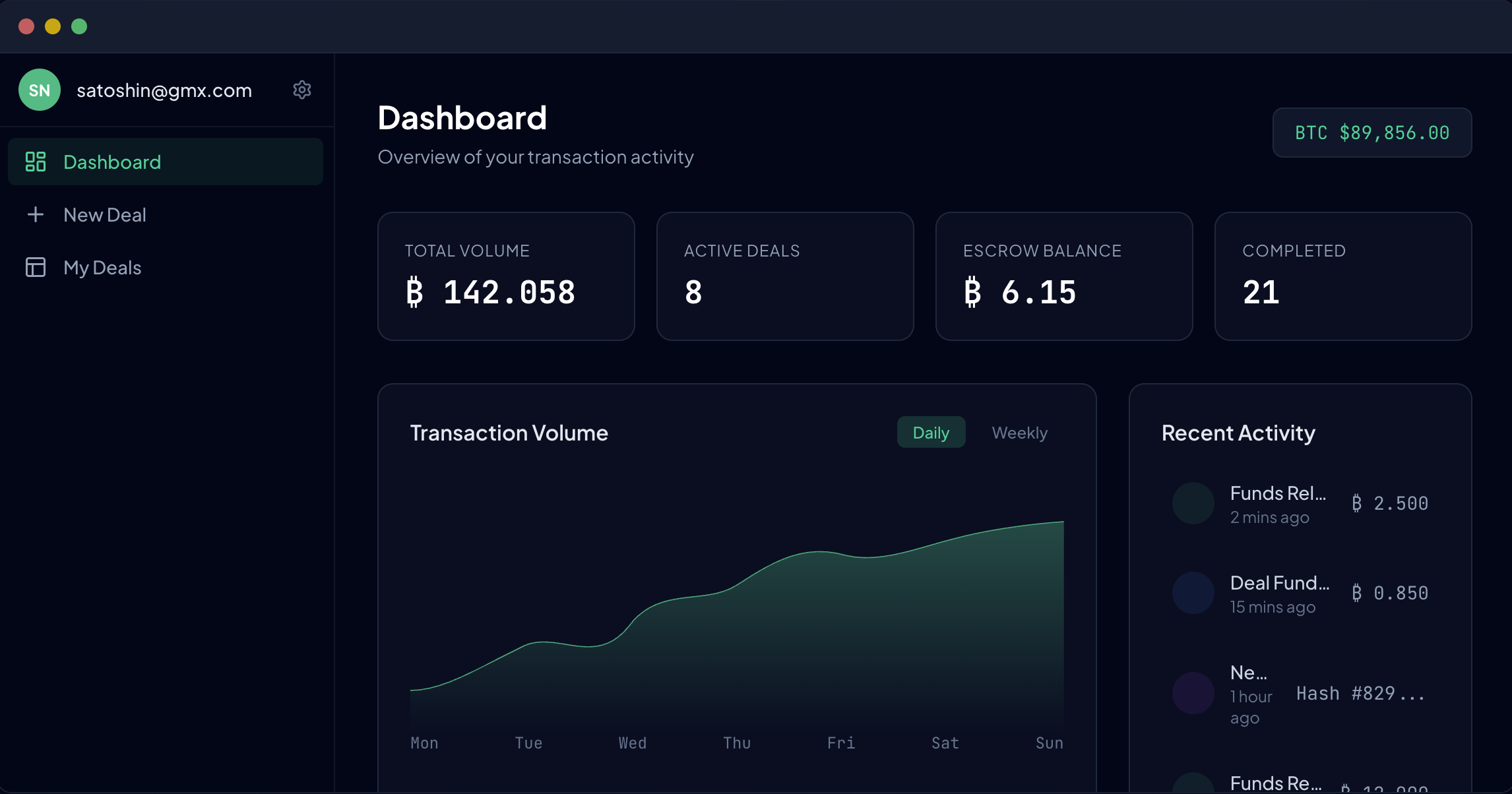

Public Beta

Tetrapolar will launch its public beta in Q1 2026.

If you are interested in following the platform’s development, subscribe to this blog or follow us on X at @TetrapolarHQ. Updates, technical notes, and release announcements will be shared there as the platform evolves.

Bitcoin is maturing into a settlement network for serious capital. Tetrapolar exists to make that settlement usable in the real world.